After several months of paying more than the minimum on time, you have finally settled the entire balance on one of your credit cards.

This is a great financial accomplishment, yet you may feel that you don’t want to go through that nightmare again, so you’re thinking of closing the credit card.

Is this really what you want?

It’s true that closing a credit card account can help you better manage your other credit accounts. Having one less credit card bill to worry about each month will certainly feel like a load is off your shoulders.

If you’re not worried about your credit score losing precious points on your credit report, feel free to do so. But if you have plans of applying for credit anytime soon, you may want to keep that account open.

An unused card can be beneficial.

Financial Industry experts agree that when it comes to your credit, you’re generally better off leaving a credit card open and not using it rather than closing an account. This is especially true if you have few positive credit score factors on your overall credit history.

Why is closing a credit card bad?

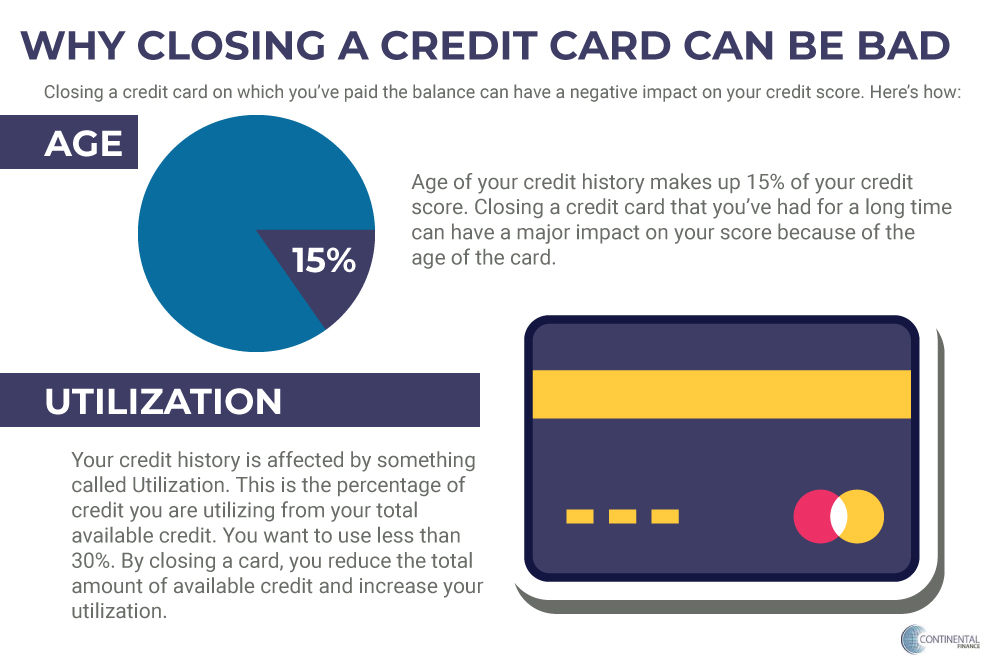

Closing or canceling an account doesn’t help your credit score; instead, it will have a negative impact on your rating and hurt your credit score. This is negative impact affecting your credit scores is magnified if the card that you’ll be closing is one of your oldest credit cards.

Age of your credit history makes up 15% of your score, so when you close your credit card, you also let go of a chunk of your credit score.

This is why it’s imperative to keep your accounts open even if you rarely use them.

And this issue doesn’t just impact people in debt. Canceling a credit card, especially an older card, affects anyone who uses credit.

Your credit history is affected by your credit utilization ratio, even if you pay off your credit card balance in full every month.

Balances are often reported to credit bureaus mid-billing cycle. And so leaving your credit card alone even after paying it off plays to your advantage.

For example, if you carry a card with a $500 limit and you charge $300 in a month you could essentially be utilizing 60% of your available credit.

That’s well above the recommended credit utilization rate of 30% or less. By changing the utilization rate you could drag your FICO score down.

But if you have a larger amount of credit available, your utilization decreases.

So let’s say you still have that $300 balance, but you have a total limit among a few cards that equals $2000, you now have an overall utilization of 15%.

Rules of thumb when considering to close a card

People should be cautious and not make credit decisions based solely on their credit score. Rather, people should look at the whole picture and make decisions based on their overall financial situation, their payment histories, their need for the credit card account, and their ability to repay debt.

So break that down into three categories:

- people with strong credit history

- bad credit history

- and those with medium strength credit history

If you have a strong credit history then closing a card or multiple cards would likely have a minimal impact on your scores. You would be looking at a small shift in points that would not affect the available credit that you would be approved for.

If you have serious credit problems and are have trouble managing the debt you have, then having open accounts may be too big a temptation. You may want to consider closing the card because it is better for your overall financial stability.

But if you’re in the middle, or in the process of rebuilding your credit, this is where closing a card and losing points to something like higher utilization percentage, causes too much damage.

Having the willpower to maintain positive credit activities, and being able to leave a card unused will over time help you maintain a better credit score.

One final tip: remember that your credit card servicer is your ally. They want to help you with your credit.

This goes beyond the basics of protection from things like credit card fraud and identity theft. The people who give you your credit card want to help you increase your credit limit, reduce your annual fee, and be aware of your terms and conditions.

With that in mind, they can help guide you to a stronger credit score, even when it comes to advice about canceling the account.

People Also Read

- How to Close Out a Credit Card

- How to Avoid Credit Card Debt

- How to Stop Impulse Spending with Your Credit Card

- Credit Cards vs. Charge Cards: What’s the difference?

Continental Finance is one of America’s leading marketers and servicers of credit cards for people with less-than-perfect credit. Learn more by visiting ContinentalFinance.net